Finance has a powerful influence on the world. Therefore, UBS partners with its clients to help mobilise capital towards a more sustainable world.

UBS focuses on the three key areas of Planet, People and Partnerships to maximise impact and drive stewardship:

- Planet: make climate a clear priority as the world shifts towards a low-carbon future

- People: address societal challenges through client and corporate philanthropy as well as employee engagement

- Partnerships: work with other thought leaders to achieve impact on a global scale

As a global financial institution, UBS understands that it has a role in tackling the United Nations Sustainable Development Goals (UN SDGs) by directing capital to where it is most needed. UBS does this through thought leadership, collaborative industry initiatives, its investment process and a focus on stewardship.

Sustainable investments as the preferred solution

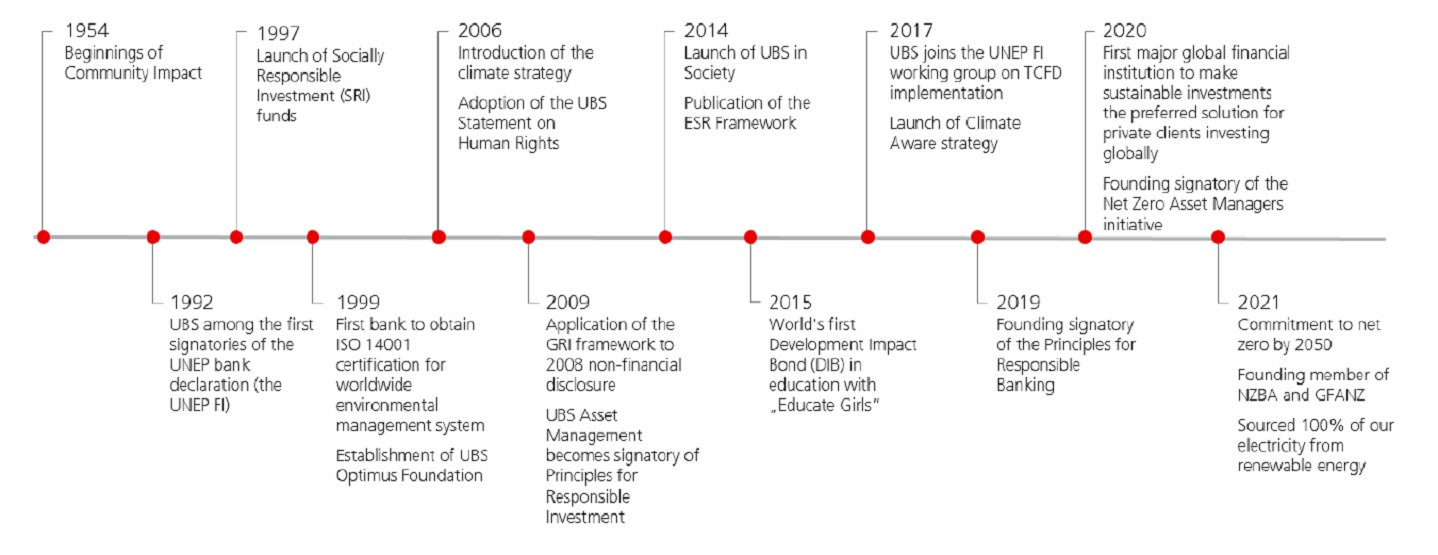

UBS believes it has the scale, connections and commitment necessary to make a decisive difference in creating a more sustainable future for all. In September 2020, UBS became the first major global financial institution to make sustainable investments the preferred solution for private clients investing globally.

UBS aims to promote well-functioning markets by taking a long-term view and driving performance excellence while influencing positive change

Working with clients, UBS delivered a wide range of sustainable finance offerings in 2021:

- Held US$251 billion in sustainability-focused and impact investments, an increase of 78 per cent yearly

- Supported 103 green, social, sustainability or sustainability-linked bond transactions and has been active in sustainable bond issuance with sovereigns such as the Philippines, Indonesia and Hong Kong

- Expanded the UBS Climate Aware suite of products and grew Climate Aware strategies to US$23.4 billion

- Supported more than 320 philanthropy programmes in over 60 countries and reached 4.6 million beneficiaries worldwide through UBS Optimus Foundation activities

Development Impact Bonds

UBS also implemented innovative financing mechanisms for social impact, such as the Development Impact Bonds (DIB). UBS developed the world’s first and largest DIB for education and the world’s first DIB in maternal and child health. In 2021, UBS launched an initiative to invest US$100 million in SDG-aligned outcomes-based programmes. Investors will receive returns based on verified social and environmental impact. The initiative is based on an innovative blended finance structure with philanthropic first-loss funding to unlock additional socially motivated private capital. Since 2020, UBS has supported over 30 innovative programmes on nature-based solutions and conservation financing.

As investors and stewards of client assets, UBS also strives to engage with companies it invests in to positively influence their sustainability practices. Discussions with company boards and corporate management enable UBS to share its expectations and encourage business practices which enhance long-term value. In 2021, UBS conducted 430 engagement meetings with companies, of which almost 40 per cent were with C-suite members. UBS speaks with companies on a wide range of topics, including corporate governance, climate change, board diversity, capital management and social issues.

Stewarding sustainable practices at the office

Internally, to engage its employees in its sustainability strategy, all UBS employees in Singapore and Hong Kong have completed sustainable investing and sustainability training programmes. UBS is further building tiered sustainability training for all staff globally. UBS creates ownership within the company through internal upskilling and enables employees to empower their clients.

To mitigate the environmental impact of its offices, UBS endeavours to achieve LEED (Leadership in Energy and Environmental Design) certification for all its new regional offices. For instance, LEED Platinum was awarded for its Guangzhou site, the highest-rated LEED office in the Guangdong province.

Planning the stewardship roadmap ahead

Moving forward, UBS is broadening its stewardship activities to cover human rights, biodiversity, health and well-being, and the circular economy, while expanding existing climate engagement activities by 2025:

- Sustainable finance: dedicate US$400 billion of invested assets to sustainable investments

- Planet: net-zero energy emissions resulting from UBS’ operations

- People: raise US$1 billion in donations and impact 25 million beneficiaries through client philanthropy

- Partnerships: contribute best-in-class sustainability thought leadership and an expert forum to engage clients and standard setters in discussion

UBS convenes the global ecosystem for investing, where people and ideas are connected and opportunities brought to life, and provides financial advice and solutions to wealthy, institutional and corporate clients worldwide, as well as to private clients. UBS' strategy is centred on its global wealth management business and universal bank in Switzerland, enhanced by Asset Management and the Investment Bank. Headquartered in Zurich, Switzerland, UBS in Asia Pacific continues to be a strategic priority for the global firm. Singapore is one of its top two major international booking centres for UBS Wealth Management business. It is also the headquarters for its Investment Banking business in Southeast Asia, and its Asia Pacific hub for foreign exchange, rates, and credit.

UBS aims to positively influence the social and environmental well-being of all local communities. Guided by its values, UBS believes in the importance of being inclusive and has engaged its local communities holistically through philanthropy, partnerships, and employee participation.

Learn more about UBS through their website. To collaborate or connect, reach out directly to our SL25 team.

Connect